TOPIC: Cyclical Growth

Investment Strategy Overview

The Cyclical Growth strategy seeks to capitalize on the natural ebb and flow of the economic cycle, investing in sectors and industries that perform well during specific phases of growth and contraction. This portfolio emphasizes sectors poised to benefit in the current economic phase while minimizing exposure to those likely to underperform, while helping balance sector concentrations created by the Secular Growth and Dividend Growth strategies.

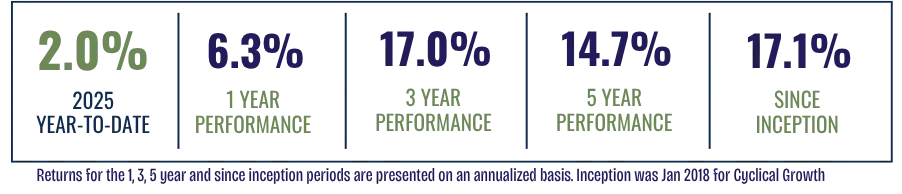

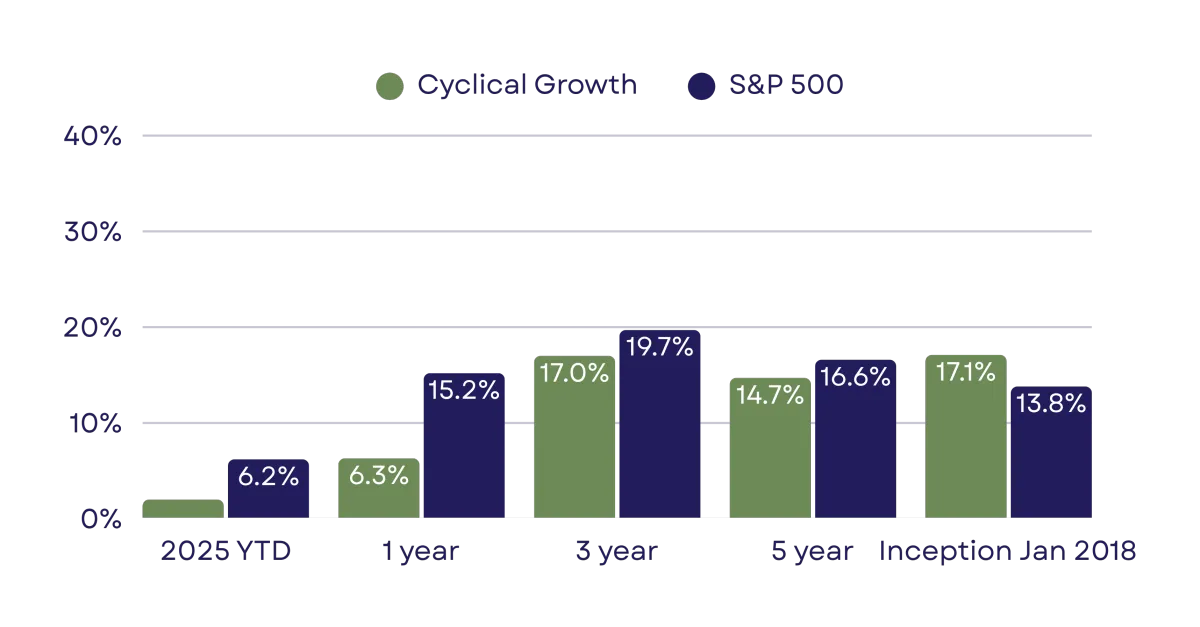

The Cyclical Growth strategy has outperformed the S&P 500 over longer periods, demonstrating its ability to capture cyclical upside during expansions while playing defense in periods of economic weakness.

Key Highlights

Focus: Invests in cyclical sectors that benefit from specific phases of the economic cycle.

Investment Approach: Tactically overweighting sectors poised for growth during economic expansion.

Risk: Moderate volatility, but high growth potential during economic recoveries.

Diversification: Exposure to cyclical industries such as consumer discretionary, energy, materials, and financials.

Performance reflects actual, unaudited returns from portfolios managed under this strategy and is not GIPS® compliant. Results are shown for illustrative purposes only and should not be relied upon for investment decisions. Past performance is not indicative of future results. The S&P 500 Index is shown for comparison only; it is unmanaged and not available for direct investment.

Why Choose Cyclical Growth?

Economic Cycle Focus

Take advantage of cyclical sectors during economic recoveries.

High Growth

Invest in sectors like consumer discretionary, energy, and materials, which thrive during expansion.

Active Management

Portfolio weightings adjusted based on the current economic phase.

Risk-Managed Exposure

Balances growth with volatility typical of cyclical stocks.

Client Considerations

For Investors Seeking:

Growth sectors driven by economic cycles.

Exposure to industries that excel during recoveries.

A strategy adaptable to shifting economic conditions.

Risk Tolerance:

Medium to High. Ideal for investors who can tolerate market volatility for strong growth potential during economic recoveries.

Learn how the Cyclical Growth strategy can help you capture opportunities as the economy grows. Rely on our expertise to guide you through the next economic cycle.