Our Commitment to Transparency and Performance

At 3 Oaks Partners, we pride ourselves on delivering superior, risk-adjusted returns through actively managed investment strategies. We understand that performance is key to building trust, and we are committed to transparency and honesty in reporting the outcomes of our strategies. This page provides detailed insights into how our Secular Growth, Dividend Growth, Cyclical Growth, and Digital Assets strategies have performed relative to industry benchmarks, such as the S&P 500.

Performance Overview by Strategy

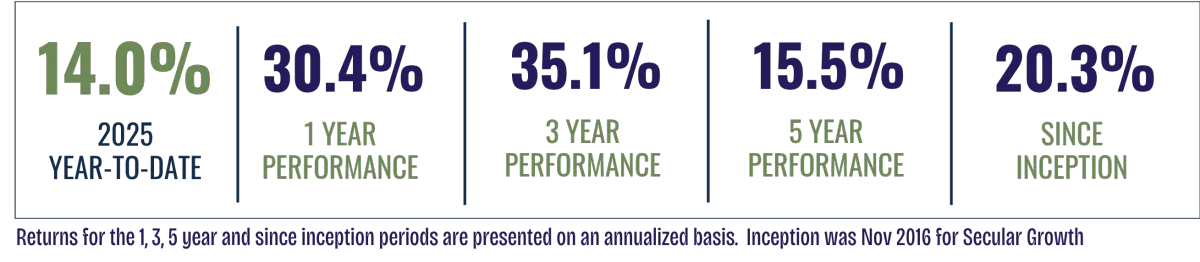

1. Secular Growth Strategy

Focus: Long-term growth driven by technological advancements, demographic shifts, and global economic transformations.

The Secular Growth strategy targets high-growth industries like technology, healthcare, and clean energy. Our concentrated, high-conviction portfolio has consistently outperformed the S&P 500, demonstrating the strength of our long-term approach.

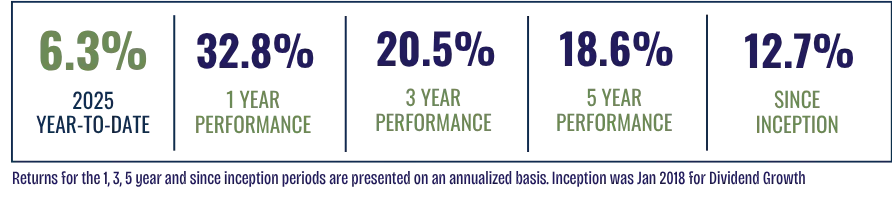

2. Dividend Growth Strategy

Focus: Proven business models with of consistent annual dividend growth

The Dividend Growth strategy focuses on investments in high-quality dividend-paying stocks with a proven track record of increasing payouts. This strategy is designed to provide steady income and capital appreciation, aiming for consistent returns through companies that prioritize returning value to shareholders. Ideal for investors seeking stability and long-term growth.

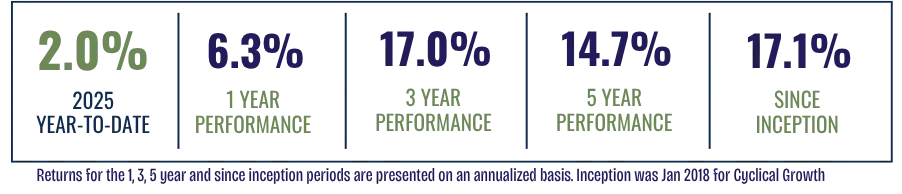

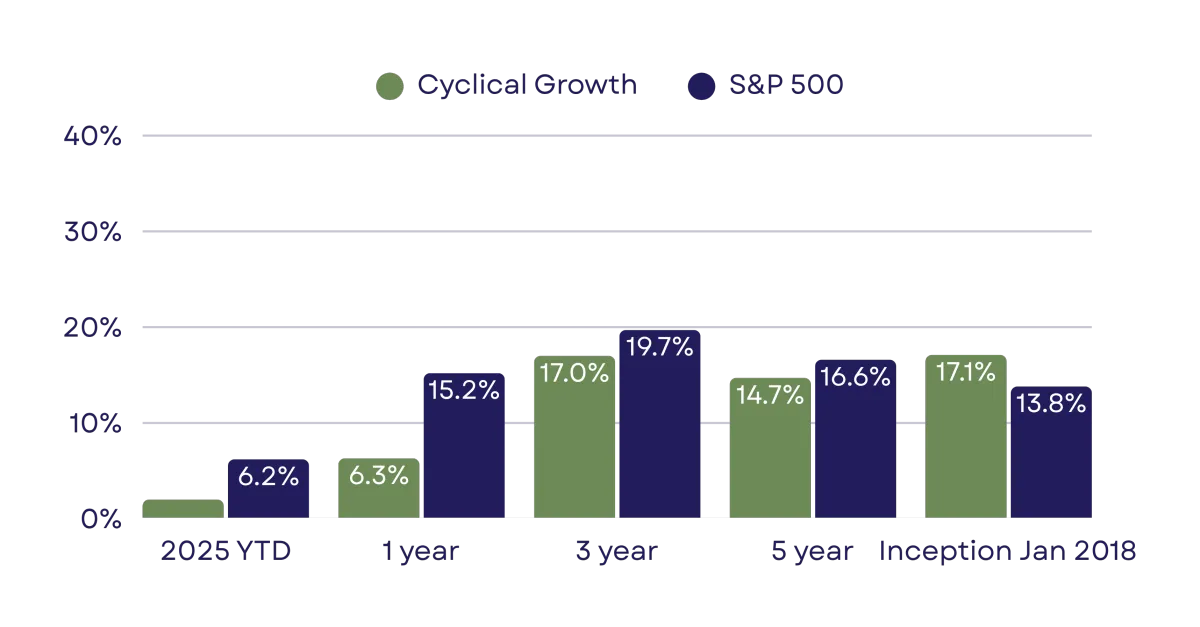

3. Cyclical Growth Strategy

Focus: Industry leaders positioned to benefit from near term economic environment

The Cyclical Growth strategy seeks to capitalize on the natural ebb and flow of the economic cycle, investing in sectors and industries that perform well during specific phases of growth and contraction. This portfolio emphasizes sectors poised to benefit in the current economic phase while minimizing exposure to those likely to underperform, while helping balance sector concentrations created by the Secular Groqwth and Dividend Growth strategies.

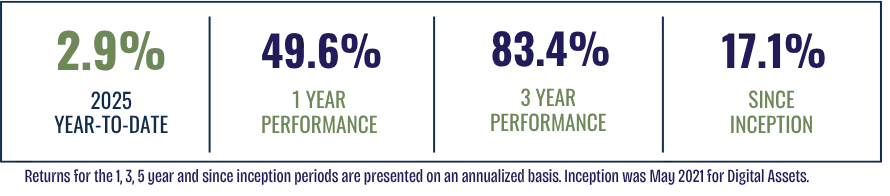

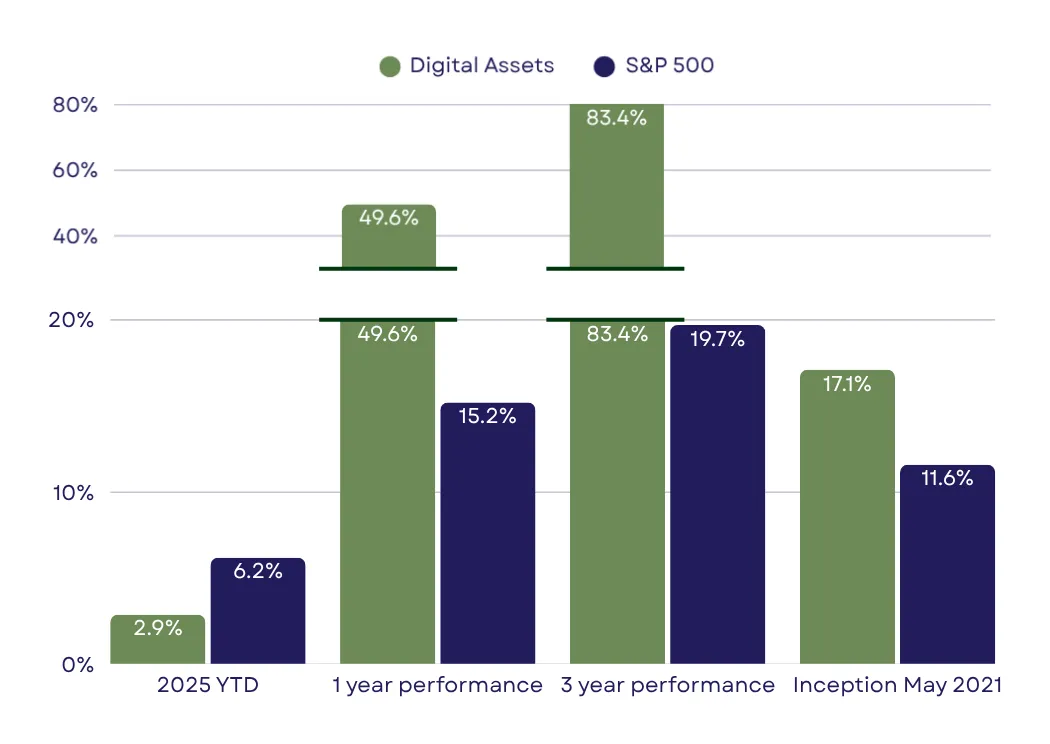

4. Digital Assets Strategy

Focus: Diversified and Risk-aware crypto ETFs and blockchain holdings

The Blockchain strategy focuses on cryptocurrencies and digital assets, targeting high-growth opportunities in the rapidly evolving world of blockchain technology and decentralized finance (DeFi). This strategy aims to capitalize on the potential of leading digital currencies and technologies, offering high returns with exposure to one of the most innovative sectors in the global economy.

Why Our Strategies Outperform

Active Management:

Our strategies are actively managed, focusing on high-conviction investments tailored to the current market conditions. Unlike passive index funds, we aim to capture market inefficiencies and outperform benchmarks.

Long-Term Focus:

We build long-term growth strategies by focusing on secular trends, economic cycles, and emerging digital technologies, ensuring consistent returns even through market volatility.

Tax-Efficient Investing:

Our low-turnover strategies help minimize tax liabilities, ensuring that your investments generate higher after-tax returns compared to high-turnover strategies.

We are committed to more than just short-term performance. At 3 Oaks Partners, we believe in sustainable, risk-adjusted returns over the long term. Our strategies are designed not only to outperform the market but also to preserve wealth and provide consistent returns, regardless of market conditions.