TOPIC: Secular Growth

Investment Strategy Overview

The TOPIC Secular Growth strategy focuses on long-term growth by investing in companies poised to benefit from technological advancements, demographic shifts, and other secular trends shaping the future. We target leading stocks in secular growth themes including AI, Biotechnology, Cloud Computing and Pharmaceuticals. Holdings may be more volatile than the broader market but may compensate that risk with higher returns.

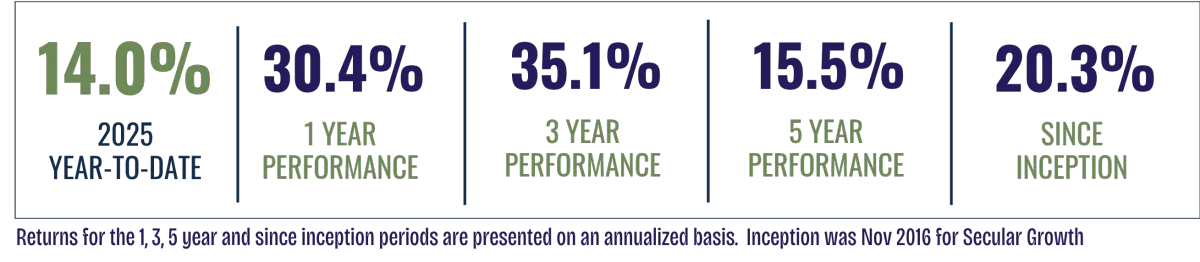

The Secular Growth strategy has outperformed the S&P 500, benefiting from high-growth trends and innovative sectors.

Key Highlights

Top Sectors Include Technology, Healthcare and Communications

Investment Approach: High-conviction positions in innovative and or disruptive companies.

Risk: Short-term volatility expected, with strong long-term growth potential.

Diversification: Concentrated investments across transformative industries.

Performance reflects actual, unaudited returns from portfolios managed under this strategy and is not GIPS® compliant. Results are shown for illustrative purposes only and should not be relied upon for investment decisions. Past performance is not indicative of future results. The S&P 500 Index is shown for comparison only; it is unmanaged and not available for direct investment.

Why Choose Secular Growth?

High Growth Potential

Invest in transformative companies in tech, biotech, and clean energy.

Active Management

Ongoing adjustments to leverage emerging opportunities.

Innovation-Driven

Focus on sectors shaping the future of the economy.

Long-Term Focus

Ideal for those who can tolerate short-term volatility for exceptional growth.

Client Considerations

For Investors Seeking:

High-growth opportunities in disruptive sectors enjoying powerful long term thematic tailwinds

A strategy requiring patience with market fluctuations

Risk Tolerance:

Medium to High. Suitable for those seeking long-term growth and willing to navigate short-term volatility

Learn how the Secular Growth strategy can help you capture tomorrow's growth today. Rely on our expertise to guide you to thematic growth opportunities