TOPIC: Dividend Growth

Investment Strategy Overview

The Dividend Growth strategy focuses on investments in high-quality dividend-paying stocks with a proven track record of increasing payouts. This strategy is designed to provide steady income and capital appreciation, aiming for consistent returns through companies that prioritize returning value to shareholders. Ideal for investors seeking stability and long-term growth.

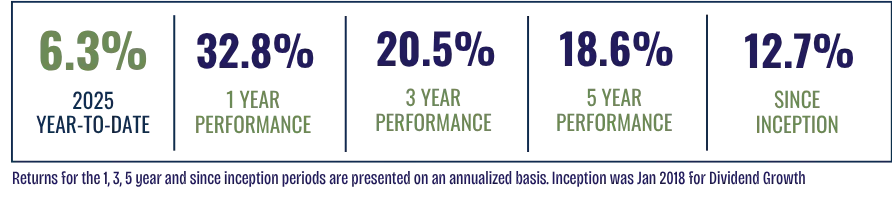

The Dividend Growth strategy has outperformed the S&P 500, offering both income stability and capital growth with lower volatility.

Key Highlights

Focus: Consistent income and capital appreciation through dividend-paying stocks.

Investment Approach: Target companies with a history of growing dividends year after year.

Risk: Lower volatility with strong downside protection in market corrections.

Diversification: Exposure to defensive sectors like utilities, consumer staples, and financials.

Performance reflects actual, unaudited returns from portfolios managed under this strategy and is not GIPS® compliant. Results are shown for illustrative purposes only and should not be relied upon for investment decisions. Past performance is not indicative of future results. The S&P 500 Index is shown for comparison only; it is unmanaged and not available for direct investment.

Why Choose Dividend Growth?

Steady Income

Invest in consistent dividend-growing companies for a reliable cash flow.

Defensive Strength

Focus on business models that can sustain future dividend growth.

Long-Term Focus

Ideal for investors seeking both income and capital appreciation over time.

Active Management

Regularly reviewing and adjusting the portfolio to focus on attractively positioned companies that increase dividends every year.

Client Considerations

For Investors Seeking:

A steady stream of growing income through dividends.

Defensive exposure to stable, cash-generating companies.

A strategy that balances income and growth, with a focus on capital preservation.

Risk Tolerance:

Low to Medium. Suitable for investors seeking consistent income and lower volatility in their portfolio.

Discover how the Dividend Growth strategy can provide you with steady income and reliable long-term growth. Rely on our expertise to guide you to growing Income.